Most so-called “guides” about cyber insurance just repeat stale tips – get insured, shop around, talk to your provider. But that stuff won’t save you during an actual attack or stop a rejected claim. Rules have tightened lately; costs are climbing fast compared to just a couple years back. Pick the wrong plan or think it handles every risk? You’ll likely take a heavy financial hit once trouble hits.

This guide cuts the hype, showing business owners the real deal – how insurance companies see risk, what gaps they won’t touch, reasons claims get denied, also steps to fix things before submitting any application.

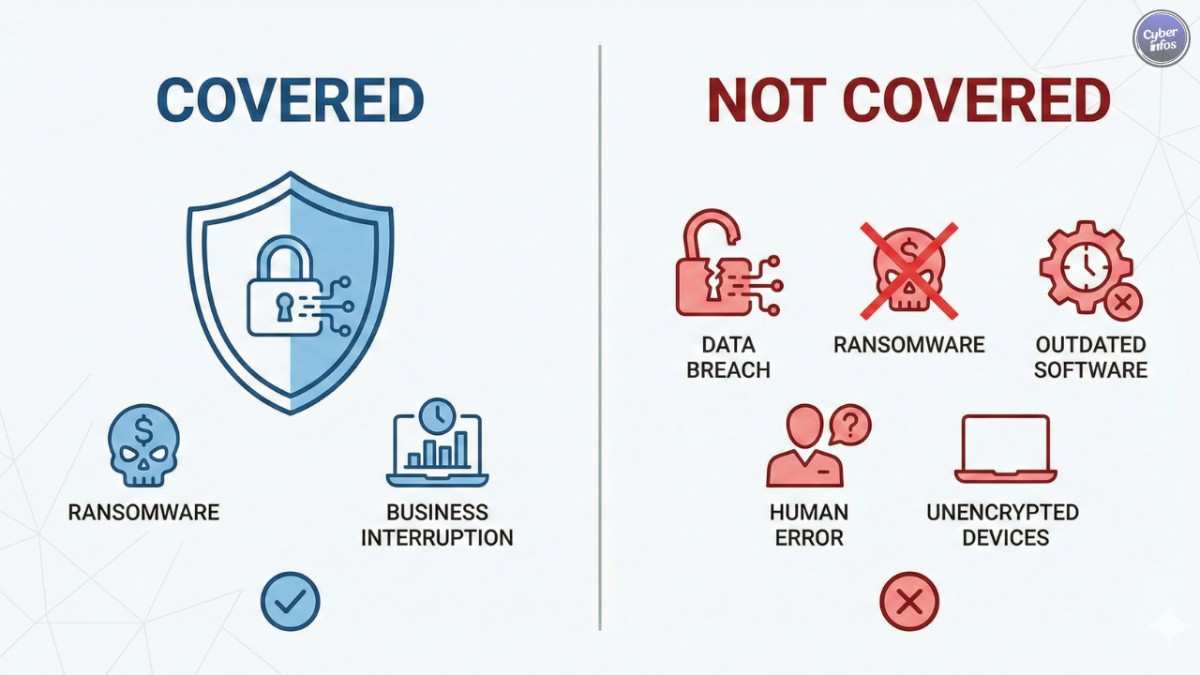

Understand What Cyber Insurance REALLY Covers – Not What You Assume

Many entrepreneurs think cyber coverage handles every digital threat – but that’s not true. Companies now follow a bare-bones security standard, so claims depend on how well you secured your systems beforehand.

Expect coverage for:

- Data breaches

- Ransomware talks followed by cash transfer

- Dealing with cyber attacks along with investigating what happened

- Business interruption

- Legal liabilities

- Notification and PR management

Yet companies leave it out behind closed doors

- Old programs you didn’t update

- Break-ins happen when passwords are too simple or there’s no extra login step

- Faults due to staff without training

- Faults from suppliers when deals aren’t solid

- Social engineering payouts minus special clauses

If you skip reading what’s not covered, there’s no protection – just a mistaken feeling of safety.

Your Security Controls Decide Whether You Even Qualify

Insurance companies aren’t giving coverage as freely as before. Get ready for lengthy forms along with required checks like:

- Multi-Factor Authentication everywhere

- EDR or XDR set up on every device

- Frequent copies of your files kept disconnected from the net

- Privileged access controls

- Email filters work alongside tools that stop phishing scams

- Patch management proof

If you’re missing these, skip the application – rejection hits right away.

Your Claim Will Be Denied If You Can’t Prove What You Did

This bit’s what every insurance company hides from you.

You need proof – skip the fancy tools

- Logs

- Policies

- Backup verification

- Employee training records

- MFA audit trails

If you don’t have proof, the insurer might – more like probably will – turn down your claim, saying you didn’t meet basic safety rules

Premiums Are Increasing – But Not Randomly

Rates are rising because:

- Ransomware payments have grown bigger

- Attack happens more often

- SMBs get hit first because they’re seen as soft spots

- Insurance companies are pushing harder for tighter safeguards

Yet this bit gets overlooked by plenty of companies: show you’re no risk, get cheaper rates.

Ways to spend less money:

- MFA everywhere

- EDR

- Regular vulnerability scanning

- Immutable backups

- SOC monitoring

If your insurer notices you take safety seriously, they’ll give you perks. When they spot carelessness, though, costs go up – or coverage gets denied.

Understand First-Party vs Third-Party Coverage (Most Owners Get This Wrong)

This difference? That’s where companies mess up – because they overlook it.

First-Party Coverage = your losses

Third-Party Coverage = your customers’ losses

If you go with just first-party coverage, legal actions could hit – also watch out for fines from regulators or missing key rules.

If you stick to outside sellers, you end up covering costs – for others, just not you.

You’ve got to have one or the other – skimping won’t work. Pick wisely.

Watch for These Common Exclusions (They Are Deal-Breakers)

Not every exclusion makes sense. A few can mislead you. Watch out for the risky types like:

- War or terror incidents – often used as a reason to avoid big cyber breaches

- Workers who harm their company from within

- Unencrypted data loss

- Social engineering fraud

- Payment misdirection

- Outdated software

If one of these things affects your work – which it likely does – then you’ll want extra protection or a side policy.

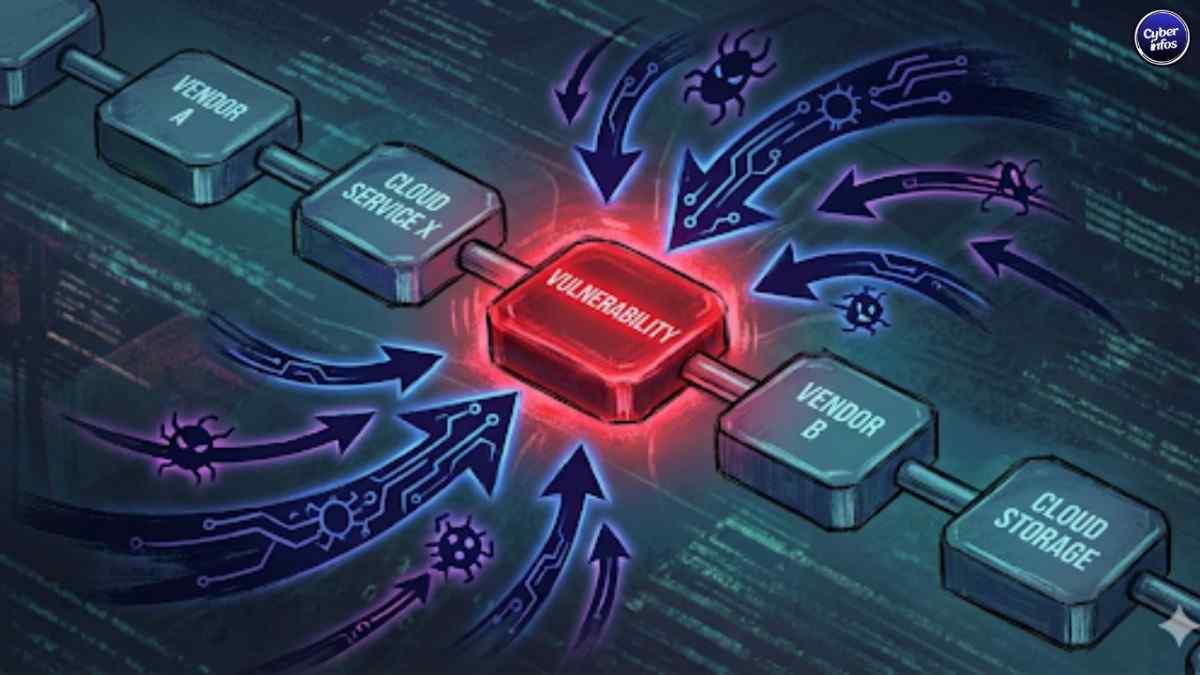

Cyber Insurance Won’t Save You If Your Vendors Are Weak

If your SaaS provider gets hacked, the insurer might shift blame to them rather than pay up – same goes for IT vendors. Cloud partners? They’re on the hook too if things go south. Breach happens through an MSP? Don’t assume coverage kicks in. Liability could bounce straight to the third party involved.

To dodge blame battles, make sure:

- Vendor deals lay out what safety steps are required

- You’re entitled to checks – also allowed to review them whenever needed

- Data handling responsibilities are documented

If your teammates cut corners, coverage means nothing. Yet weak links sink strong plans fast.

Don’t Buy Coverage Without Matching It to Your Real Risk

Companies sometimes pay too much for overloaded plans – or end up paying too little for protection that doesn’t help.

Your protection needs to line up:

- Nature of operations

- Volume of client details

- Dependence on online storage systems

- Critical setups keep things running when trouble hits

- Regulatory requirements (GDPR, PCI-DSS, HIPAA, etc.)

A 50 lakh policy for a firm handling private info? Totally laughable.

A ₹2 crore plan for a small-scale operation could be excessive – maybe even unnecessary.

Check the actual risks – don’t just assume.

You Must Review the Policy Annually (Cyber Risk Changes Too Fast)

Threats shift every few months. Because insurers keep changing rules, sticking to old policies can catch you off guard – soon enough, you’re out of compliance and left uncovered.

Review:

- Limits

- Exclusions

- Riders

- Vendor dependencies

- New security technologies

- Updated regulatory obligations

Yearly check-in? Absolutely mandatory.

Final thoughts

Cyber insurance won’t save you by itself. This deal comes with rules, duties, because real protection needs effort. Buy it without checking details? Then expect trouble during crises. Yet treat it wisely – use safeguards, keep records, grasp the terms – it turns into solid support for your company’s money safety.